Kezdjük hát el! Sok hír, kevés magyarázat, kommentelési lehetőség. Mint a mesében. :-)

Nagyjából az történt, amire számítottunk. Az OPEC hivatalosan nem csökkent, mert nem akarja magát kitenni a vádaknak, hogy ők tehetnek a magas árakról. Ugyanakkor a gyakorlatban csökkenteni fognak, sőt, pár hete már teszik is, csak nem jelentették be. Mivel több mint 500 ezer hordóval a kvóta felett teljesítettek, elkezdtek visszamenni a vállalt szintre. Tehát csökkentés is meg nem is. Megvárják, mit hoz a szeptember vége és az október eleje, ha az árak tovább esnének, csökkentenek akkor. Szerintem pont abban bíznak, amitől én tartok: az árak jelentősen emelkedni fognak így is. Hamar.

Oil ends at 5-month low on OPEC talk

Oil prices fell Tuesday, as investors believed OPEC will keep production at current levels, and as Hurricane Ike lost strength over Cuba. U.S. crude for October delivery settled down $3.08 to $103.26 a barrel, the lowest close since April 1, when oil ended the day at $100.98 a barrel.As the cartel met in Vienna, traders listened for word on possible production cuts. The oil minister of Saudi Arabia, Ali Naimi, indicated that he did not think the production levels need to be changed, according to reports from the Associated Press."The market is fairly well balanced," Naimi told the AP on Tuesday. "I think things are in balance, in a healthy position." Because Saudi Arabia is a heavyweight in the cartel, Naimi's comments were closely watched. A day before, the oil minister from Kuwait expressed similar sentiment.The meeting was still in progress as floor trading ended in New York."If they cut production to try to shore up prices, that would be viewed very unfavorably by the markets that are struggling," said Phil Flynn, senior market analyst at Alaron Trading.

Kezd bekövetkezni, amiről nagyjából egy éve eszmét cseréltünk: az energiát immár a hadsereg őrzi sok helyen. Tudjuk, hogy a Gazprom állam az államban, saját hadsereggel gyakorlatilag. Maga a jelenség azonban nem az oroszokról, hanem a helyzetről mond el valamit. Az oroszokról csak annyit, hogy ez ügyben is hamarabb eszméltek sokaknál.

Bolivian troops guard gas lines

The army in Bolivia is sending in troops to guard gas pipelines to guarantee exports to neighbouring Brazil and Argentina. The move comes amid growing anti-government protests in the east, where most gas fields are situated. Demonstrators have been blocking roads and taking over government buildings to demand that the referendum on a new constitution be suspended. They also want more of the revenue from energy exports.(…)Bolivia has the second largest natural gas reserves in South America but they are situated in the east of the country, where Mr Morales faces his main opposition and there are growing calls for greater autonomy. Brazil, and to a lesser extent Argentina, are Bolivia's major gas customers and any interruption to supply would have a serious effect on both economies as well as damaging Bolivia's reputation as a reliable supplier.

Indiában (hol éjjel a vadak...). Ahol - ha még emlékszünk - természetesen sem szénhiány, sem dízelhiány nincsen, a vonatkozó minisztereik szerint. Áramhiány viszont van. Az áramot arrafelé szénből és dízelből csinálják. Most akkor mindenki rakja össze magának, hogy miből van és miből nincs hiány.

Szerintem dezinformációból és propagandából semmiképp nincs hiány, de hát ez ugyebár csak az én véleményem.

Malls, hotels shell out more to fight power cuts

It is not just residents who having to sweat it out during the daily power outages. Shopping malls, hotels, hospitals and other establishments in the city too are hugely affected by these scheduled power cuts. The administrators of these facilities state that this is mainly due to the large amount spent on running generators and shortage of diesel.The state is facing a 2,000 mega watt shortage due to failure of wind power and lack of implementation of any major projects in the past 10 years. Due to this the Tamil Nadu Electricity Board (TNEB) had implemented scheduled power cuts in the city for an hour and for more than three hours in the suburbs and moffusil.As establishments like malls, hotels and hospitals witness a continuous flow of visitors, generators are used to ensure continuous power supply. But now the shortage of diesel and the large quantity of the fuel that needs to be used, is burning a hole in their pockets.

Ez a hír a kommentek közt már szerepelt, most csak megerősítésként teszem be, mert fontos dologról van szó. A szerbek igen nagy (89%-os) többséggel határozták el a következőket:

- orosz csővezeték menjen át rajtuk

- épüljön gáztározó (virágozzék száz virág!)

- vegyék meg az oroszok a szerb olajtársaságot

A csővezetékkel (Gazprom) egyébként gyakrlatilag együtt jár az orosz hadsereg leányvállalata, a Gazprom magánhadserege is. ezt nem írták meg, úgyhogy gondoltam, érdemes lesz megjegyezni.

Nem tudja valaki véletlenül... határosak vagyunk mi Szerbiával? :-/

Serbia's Parliament Ratifies Energy Deal with Russia

Serbia's parliament ratified an accord on Russian investment in the Balkan country's oil and gas industry by a vast majority on Tuesday. The deal clears the way for Russian gas giant Gazprom to build a pipeline in southern Serbia and an underground gas storage facility in northern Vojvodina province, and to buy the Serbian oil monopoly NIS.Out of 238 deputies present at the televised session, 212 MPs voted for the accord, 22 were against it and four abstained from the vote.

Lassan, ám annál bizonytalanabbul ugyan, de az amerikai sajtó is kezd tovább látni az orránál, és nem csak az aznapi tőzsdei árakkal foglalkozni. A jelenség üdvözlendő, a konkrét elemzés kevésbé (noha - illetve éppen azért, mert - korrekt).

Ezt kiszínezem. :-)

Storm Warning: Ike’s Impact Could Go Far Beyond Hurricane Season

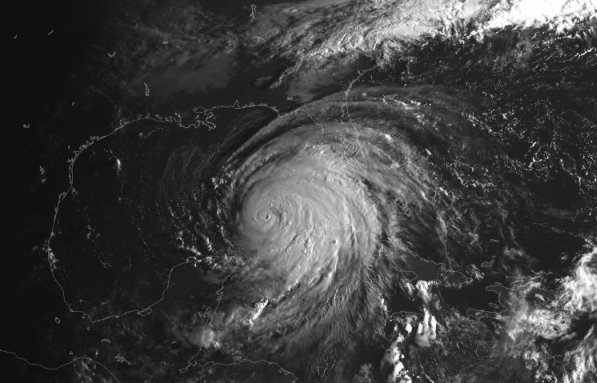

While armchair meteorologists are plotting Hurricane Ike’s path into the Gulf of Mexico, trying to divine what could happen to vulnerable Gulf oil installations and oil prices, the real problem isn’t short-term price spikes or even refinery outages that drive up the price of gasoline.

Headed for the Gulf? (AP)

The real problem is that thanks to hurricanes, the Gulf of Mexico will never live up to its promise as a mother lode of U.S. domestic oil production, leaving the country even more vulnerable to imports. Then the question becomes—imports from where?That’s the argument laid out in a new report from Jeff Rubin at Canadian investment bank CIBC World Markets, the guys who earlier this year projected $200 oil. Hurricane damage in the Gulf isn’t limited to evacuated rigs or shut-in refineries; the real damage from increasingly brutal storm seasons is the long-term delay in getting new oil fields up and producing.Three years after Hurricane Katrina, the Gulf still hasn’t recovered its pre-2005 production levels, CIBC notes. Thanks to rapid production declines at existing fields and huge delays getting new fields operational, official U.S. government forecasts for the Gulf’s role in U.S. oil production are wildly overblown, Mr. Rubin says:Instead of ramping up production to over 2 million barrels per day as once dreamed by the Departments of the Interior and Energy, Gulf of Mexico production is likely to fall to a low of a million barrels per day by 2013—a third lower than the region’s production prior to the 2005 storm season.

No komment.

Will rising fuel costs reverse globalization?

As much as we would like it to be, the world is never a stable place for very long. After the technology bubble and the terrorist attacks of 9/11 in the early years of this decade, we managed to eke out about five years of relative economic stability. Now we understand that the U.S. was only incubating its current credit crisis, and that rising commodity prices - especially for oil and food - are raising the spectre of inflation once again.A subject of lively debate among economists and business analysts today is the effect of rising oil prices on globalization. Rising oil prices translate into higher fuel costs, and that in turn drives up shipping costs. Ninety per cent of global demand for crude is based on the need for transportation fuels. In a world of triple-digit oil prices, could it cost less to manufacture products more expensively at home rather than ship cheaper products half way around the world? Could rising oil prices slow, stall, or even reverse the trend of globalization?

Végezetül pedig: egy kis megerősítés. Mindig öröm, ha néhány hónap késéssel megírja az újság (is), amit az egyszeri ember 2 perc alatt kikövetkeztet. Ha figyel.

Could 100-dollar oil become a new OPEC price floor?

VIENNA (AFP) - With the oil market falling rapidly, questions have been raised at a gathering of OPEC producers in Vienna this week about whether 100-dollar oil should be a minimum price to defend, analysts say. For the past five years, crude prices have been on a steep upwards path, peaking in July at 147 dollars a barrel amid widespread concern among consumer and producer countries about the impact on economic growth. But the dizzying run-up has been followed by an equally steep fall, with prices now around 110 dollars, leading OPEC members to consider the desired price for their vital exports.Iran and Venezuela, two traditional prices hawks, have made it clear they regard 100 dollars as a level to protect -- something that was considered dangerously high by observers at the beginning of the year. "We're going into an election period in Iran and the government has more money to pump into the economy to build popularity with 100-dollar prices," said an analyst at PFC Energy David Kirsch, referring to presidential elections next year."Venezuela needs a 100 dollars a barrel to balance their accounts," he said, adding that Iran could balance the books "somewhere around 66 dollars a barrel." Ecuador, OPEC's smallest nation by output and a Latin American producer like Venezuela, considers 110-120 a dollar barrel as "reasonable." A price of "between 110 and 120 dollars is a reasonable price," Ecuadorean Oil Minister Galo Chiriboga told reporters as he arrived in Vienna on Monday.

A többit kommentbe teszem.

ÁJK

Utolsó kommentek